Letter Of Credit

- Home

- Letter Of Credit

LETTER OF CREDIT PROCESS

You can open Documentary Letters of Credit on behalf of your company at ZERO Cash Margin by contacting us. We are the Trusted Letter of Credit Providers in Dubai.

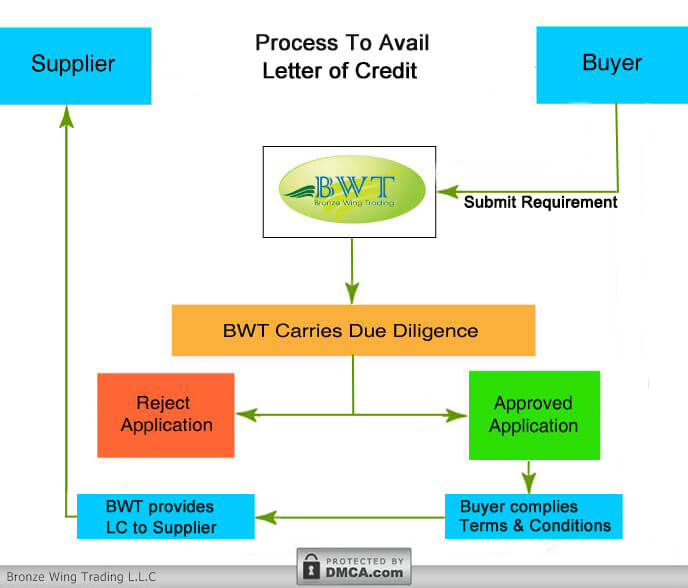

Follow the simple Letter of Credit Issuance process to open Import LC at ZERO Cash Margin:

1. The client submits their LC request with the signed proforma invoice or contract of their trade deal. Also, they inform the amount and the tenure of their required LC.

2. We examine the trade details and inform the client about the approval or rejection of their LC request.

3. Once approved, we will send a service agreement to the client. And also, inform them about the service charges to begin their LC at Sight transaction.

4. Once we signed the agreement and received the service charges, we will start work on their transaction. We will block our bank limit; then, we will provide the MT700 draft for their review and approval.

5. After receiving the documents, draft approval, and LC issuance fee, we will request our bank to issue the required MT700. We assure you that it will not take more than 2 banking days to conclude the deal.

We will get back to you within 24 working hours

Looking to Open LC at Sight?

Send us your requirements, we can provide Sight LC within 2 banking days!

What is Letter of Credit?

A Letter of Credit is a written undertaking issued by a bank assuring the buyer’s payment towards the seller. It is also called irrevocable LC, Import LC, LC at Sight, LC MT700, DLC MT700. This is to assure the seller that they will receive the payment for the supply of goods, once they submit the shipping documents. Due to the nature of global trade dealings & its risks factors including distance, different laws in each country, and trust issues between the traders, the use of Letter of Credit has become a vital part of global trade. When a buyer & a seller from two different parts of the world decided to do business, there might be uncertainty in trust and payment will arise. To bridge the gap between the traders & to build trust, Letters of Credit are being used. Usually, Import LC & LC at Sight which is valid for 90 days and 180 days is always irrevocable. It means a bank provides an irrevocable commitment to the seller, that they will get paid if they comply with the terms stated in the issued Irrevocable Letter of Credit. Also, it assures that if the buyer is unable to make the payment or went bankrupt, then the bank will be liable to fulfill the payment terms as agreed in the contract. Hence this is an irrevocable commitment made by the bank, Letters of Credit are mostly preferred by buyers and sellers, as an LC Payment Term in International Trade.

How Does a Letter of Credit Work?

When it comes to global trade, buyers run the risk of not receiving goods from the seller for which they have already paid. On the other hand, sellers run the risk of nonpayment by the buyer for the supplied goods. Hence, in this case, the traditional payment method used earlier for global trade has failed. So, the International Chamber of Commerce (ICC) introduced MT700 to secure the interests of both parties involved in trading. While using LC Payment Term, the buyer’s bank assures to pay the seller for the supplied goods; upon complying with all terms & the submission of documents as stated in the issued Letter of Credit. In case, if the seller fails to submit the documents before the deadline, the LC will be expired. Then the bank will return the funds to the buyer’s bank account which they deposited while LC Opening. Hence, this way, the risk of default in the payment & the delivery of goods goes down to zero percent.

Documents required for a Letter of Credit

To open a Letter of Credit on behalf of your company at ZERO Cash Margin, you need to arrange the following paperwork:

- Signed Copy of Proforma Invoice or Sales and Purchase Contract of your Trade Deal

- Company Registration or Trade License

- MOU between partners (if any) along with Company Ownership Document

- Passport Copy of the Authorized Signatory

- Authorized Signatory’s Residence or Company Utility Bills as Address Proof

- Past 6 Month Bank Account Statement Copy

Once all these documents are received from your end, you can contact us with your LC request. And we will start work with our bank to structure your Letter of Credit transaction.

To Open LC at Sight or Import LC at ZERO Cash Margin

Parties Involved in Letter of Credit

In general, the following are the parties involved with Letters of Credit. Here’s what each party role and what it does:

Applicant: The Applicant or the buyer who requests the bank to issue the LC MT700 in favor of their supplier.

Beneficiary – The seller who receives the MT700 in their bank account, called LC Beneficiary.

Issuing Bank – The bank who issues the MT700 on behalf of their customer, called LC Issuing Bank.

Advising Bank – The advising bank receives the MT700 from the issuing bank and advises the LC towards the seller’s bank.

Negotiating Bank – The seller’s bank who receives the LC works also as a negotiating bank on their client’s behalf.

Letter of Credit Benefits

Not just the buyer, but the seller also gains lots of benefits by using Import LC as a payment term. And it includes:

For Exporter

- The buyer can’t cancel or alter an order without the approval of the seller. Hence, the production risk becomes zero.

- The buyer’s bank has the obligation to pay for the shipped goods.

- The buyer can’t refuse to pay for the supplied goods, as long as, the seller complies with the terms of credit.

- Payments are secured; if the buyer opts for a deferred payment.

For Importer

- The bank is liable for the payment of goods or services on a precondition. If the seller would provide all the documents required, according to the terms of MT700.

- Through an LC, the importer is indeed proving their solvency.

- In most cases, the buyer is able to control the shipping of goods.

- If the seller provides a deferred payment option, it means that the seller has been granted a credit period for the payment.

- Pre payments become negligible under import LC.

No Lengthy Procedures! Fast Issuance!

Types of Letter of Credit

Irrevocable Letter of Credit

This type of Letters of Credit cannot be amended or changed without the consent of all parties involved. Most of the traders prefer Irrevocable LCs. This is because Irrevocable LC gives the security that most suppliers want.

Transferable LC

As it says, this can be transferable to the principle party upon request of the 1st beneficiary. This is because, in some cases, the first party is playing the role of a middle party under this type of Letters of Credit.

Confirmed LC In some cases, sellers may not trust issuing bank that provides LC on behalf of the buyer. Hence, they might require a bank in their home country to confirm the LC.

LC at Sight 60 Days / LC 90 Day After Sight

This type of LC is commonly used in domestic and global trade. Also, this guarantees that the bank will release the payment; once the seller submits all the documents as mentioned in the credit.

Back to Back Letter of Credit

This type of Letter of Credit Back to Back normally issues against the Master LC. This is to say, here, at first, the LC opened in favor of an exporter from an importer’s bank. Then, on the basis of the Master LC and the credit facility available in the exporter’s account. Further, the exporter’s bank will open a new LC, in favor of their principal seller.

Letters of Credit Cost

The cost of Letters of Credit may vary based on the amount & its tenure. Usually, the cost may include bank commission, processing fee & swift charges. Further, the cost is borne by the Applicant (buyer). Also, it should be clearly stated on the issued LC. For more info on the Cost, Contact us.

Letter of Credit Providers

Bronze Wing Trading L.L.C., the Letter of Credit Providers in Dubai provides LC MT700 on your behalf without any cash margin. By offering Letters of Credit from rated banks, we help traders who do not have enough credit lines in their bank account to conclude their trade. If you are looking for a secure, easy, and reliable way to get MT700 to conclude your trade, Fill up the Form Available Here! We can provide you with the required LC at Sight from European Banks at Zero Cash Margin!

Not just the buyer, but the seller also gains lots of benefits by using Import LC as a payment term. And it includes: