Performance Bond

- Home

- Performance Bond

HOW TO GET PERFORMANCE BOND

We, the Performance Bond Providers in Dubai can support your exports or projects by providing a Performance bond on behalf of the seller / Contractor.

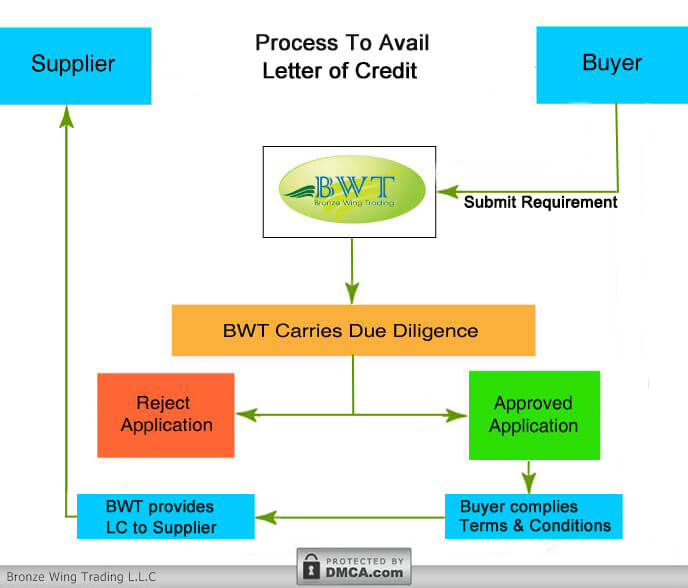

To apply for MT760 from rated banks, please follow the simple process given below:

1. The client submits their MT760 request to us along with the pro forma invoice or contract of their deal.

2. Secondly, BWT will analyze the deal between the parties involved. If their request is approved, the client needs to sign the service agreement with us. Also, they need to pay admin charges to start work on their bond request.

3. Instantly, we will start structuring their transaction by blocking our bank limit.

4. Next, we will send the bond (PB) draft for the client’s approval. Also, we will ask them to pay the PB issuance fee charges.

5. After receipt of the draft approval and issuance fees, we will instruct our bank to issue the Performance Guarantee from our account on behalf of the client. Accordingly, our bank transmits the required bond to the counter party’s bank account via SWIFT MT760.

We will get back to you within 24 working hours

PERFORMANCE GUARANTEE PROCESS VIDEO

LATEST TRANSACTION

Performance Bond Issued for a UAE Construction Contractor

A Construction Firm in Dubai approached us for a Performance Guarantee for their building construction project. We blocked our bank limit with our European Bank. And on account of that, we facilitated the required Guarantee in favor of their developer to assure the contractor’s commitment to complete the project on time.

Apply for Performance Bond MT760 without Blocking Your Cash Funds

What is Performance Bond?

Performance Bond or Performance Guarantee or Surety Bond is a Bank Instrument issued by a bank on its clients’ behalf to assure their performance as per the stated contract or trade deal.

This type of bond is mostly used in construction projects. Here, the contractor provides this bond in favor of the project owner; to assure the positive completion of the work on the project. Further, this protects project owners against any claim; in case of non performance by the contractor; against the agreed contract. As a result, the main aim of this bond is to assure the project owner; that even in case of any default – such as bankruptcy or any events, the work will not be stopped.

At the same time, Performance Bond also plays a vital role in trade. This is issued by the seller; in favor of their buyer before opening the DLC MT700 from their end. In this way, the issued bond MT760 will act as a guarantee that the goods will be supplied, once the seller receives the DLC MT700 at their bank counter.

Getting such bonds from banks can be tough; as they will demand you to block 100% cash funds. We, the Performance Bond Providers in Dubai are aware of these difficulties; and so, we’re ready to provide you the required MT760 without blocking cash funds.

How do Performance Bonds work?

When entering into a contract or trade deal, the contractors or the sellers are required to provide a Performance Bond. And this assures their commitment to complete the task on time. Further, this bond also assures the project owners; that in case of any default against the contractor or seller; then the counter party can claim the bond.

Further, this bond also works in such a way to give full protection to the project owner or buyer; by stating that the work or the supply will not affect; even if the contractor or the seller declares bankruptcy or faces other fiscal issues that would preclude them from completing the work.

Since this bond gives utmost protection against contractor’s or seller’s default; having a Performance Guarantee is one of the most required documents to sign worthy contracts and trade deals.

Advantages of Bank Guarantee

- Improve the credit ratings for issuers of industrial growth, revenue bonds, and commercial papers.

- Provide backup facilities for loans granted by third parties.

- Assure performance under construction and employment contracts.

- With BG, you can spread your working capital around, rather than tying up in a single project or trade deal.

Enter into Worthy Trade Deals and Contracts by Availing MT760 Guarantee

Performance Bonds in Construction Contracts

Mostly, the contractors use Performance Bonds in construction contracts. For instance: if you won the bidding process; the project owner may demand you to provide a bank guarantee MT760; before you start working on the project. This is to assure your performance and also, to give protection to project owners against any default.

Usually, when it comes to availing BG MT760, contractors contact their bank with their BG requests. The bank will consider their request and issue the BG; only if they have the Bank Facilities available; or have enough cash funds to block as collateral in their account.

In case, if you face a lack of cash funds to block in your account to avail a Bond from your bank; then you can contact us with your request.

To apply for MT760s, you can submit your requirements here. Applying for a performance bond with us is pretty simple. If you have all the paperwork done and paid the charges on time; then we can complete the issuance process in 2 working days.

Parties Involved in BG MT760

There 3 parties involved with MT760 and they are:

Principal – Also called as Contractor or Seller; they are the ones who request the bank to issue the Bond which assures their commitment; to complete the project or a supply of goods on time.

Obligee – The project owner or buyer who receives the bond in their favor from the contractor or the seller.

Bank– Who issues the bond; and assures the project owner or the buyer that the contractor or seller will perform the tasks as per the contract terms.

How Much Does a Performance Bond Cost?

The cost of a Performance Bond varies based on the tenure of the required bond. Usually, it includes bank commission, processing fee, and other handling charges. Further, the client should bear the charges. Also, to be noted that before issuance, the bank will debit these charges from the applicant’s account.

Performance Bond Providers in Dubai

Bronze Wing Trading L.L.C., the Performance Bond providers in Dubai are here to assist clients globally to avail Performance Bonds without blocking cash funds! For the past 30 years, we have helped more than 25,000 traders and contractors to support their trade deals and contracts.

Do you require Performance Bonds to assure your performance towards your counterparty? Avail Performance Guarantee from us on your behalf!